how to calculate stock up rate

In other words the rate of return is the gain or loss compared to the cost of an initial. To calculate your profit or loss subtract the current price from the original price.

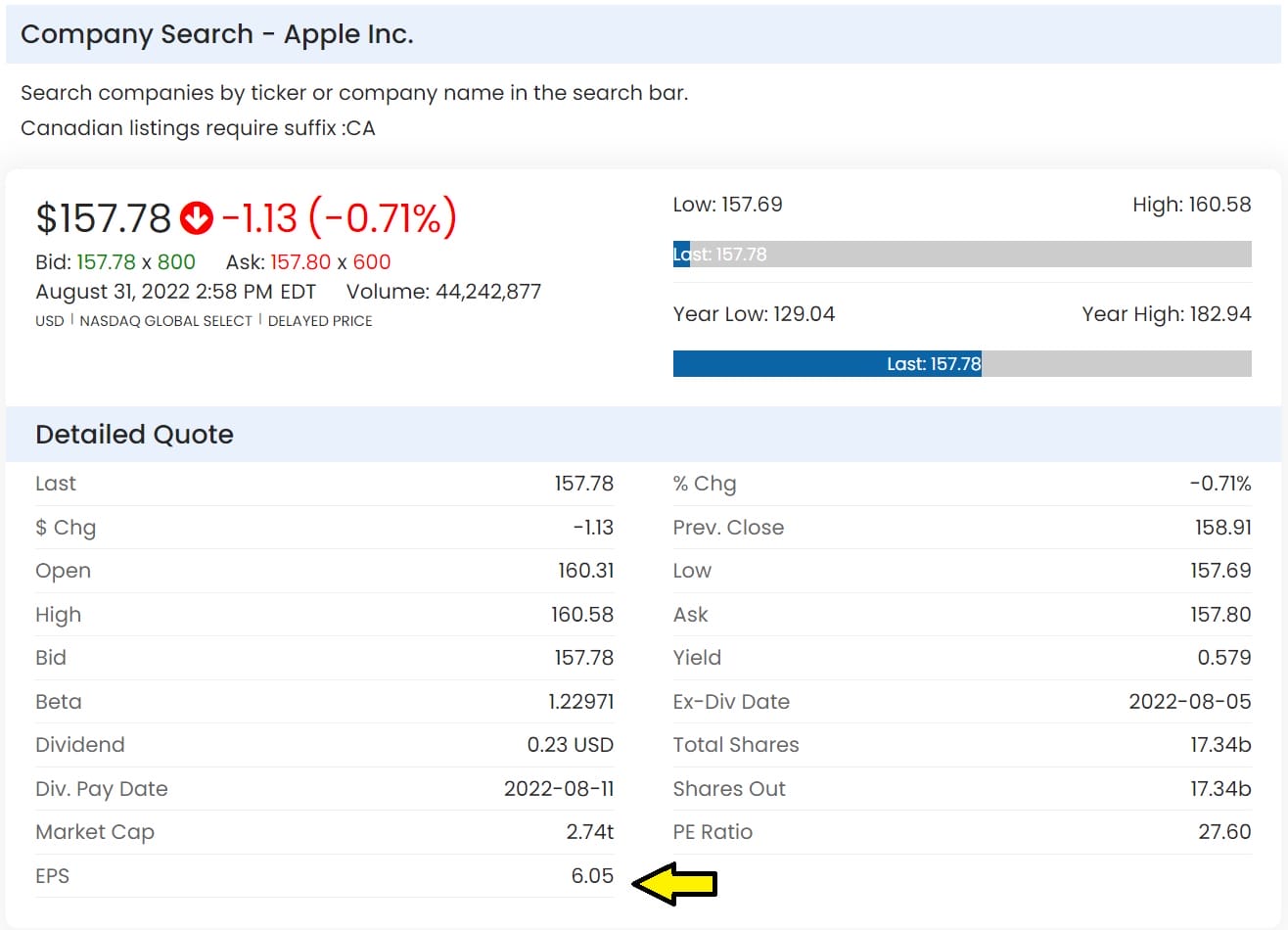

How To Tell If A Stock Is Cheap Learn How To Calculate A P E Ratio And P E To Growth Ratio Nasdaq

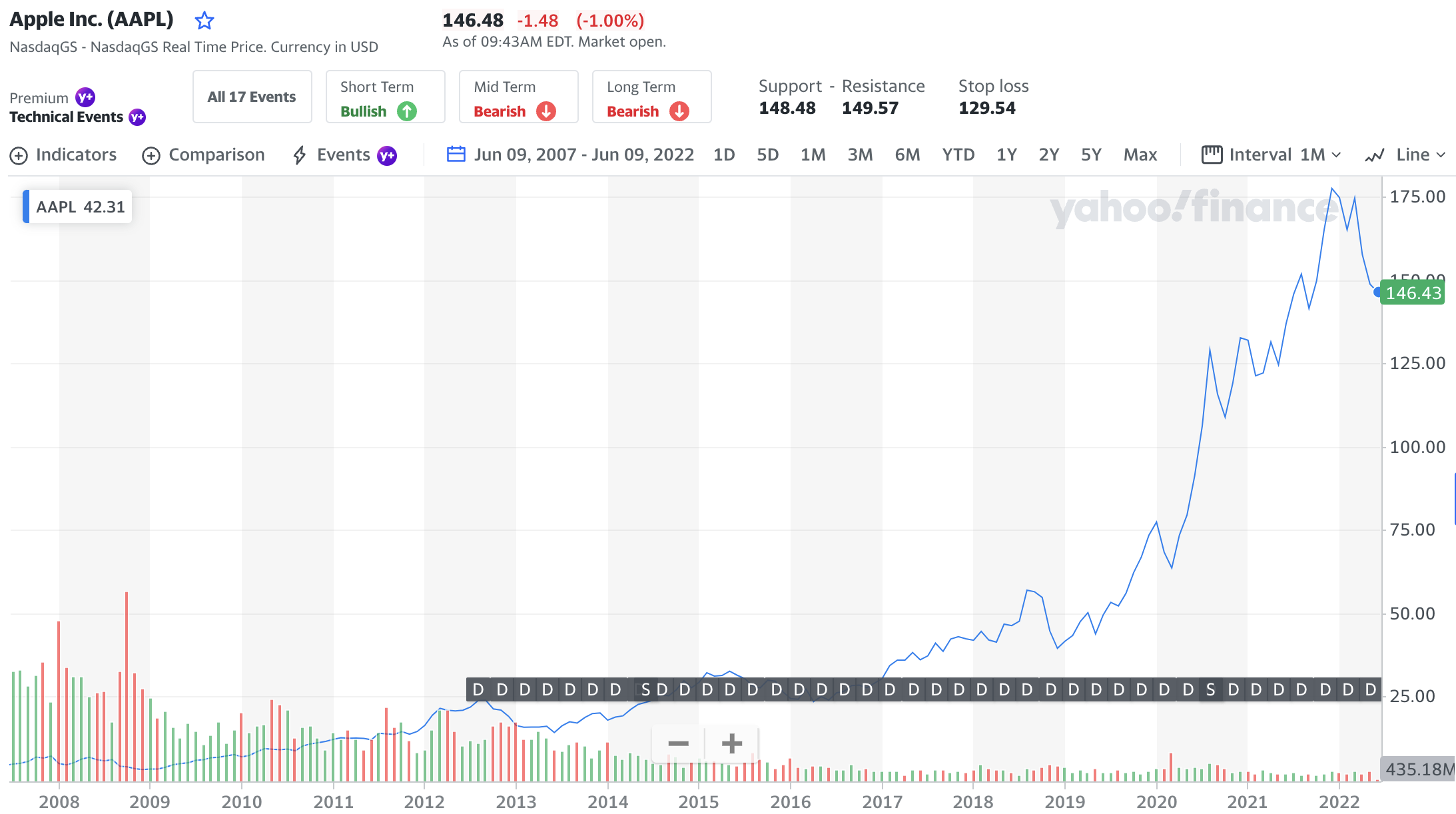

To calculate a stocks market cap you must first calculate the stocks market price.

. Enter the purchase price per share the selling price per share. Simple Return Current Price-Purchase Price Purchase Price. Traders can use the tool to form comparative analysis between different brokers.

So if a customer. 1 day agoJumbo Mortgage Rates. You would need to know how many items in the store and how many outages there are and also if any items of an empty spot are in the back room.

Now that you have your simple return annualize it. The median rate for a 15-year fixed mortgage is 612 which is an increase of 12 basis points from seven days ago. Enter the number of shares purchased.

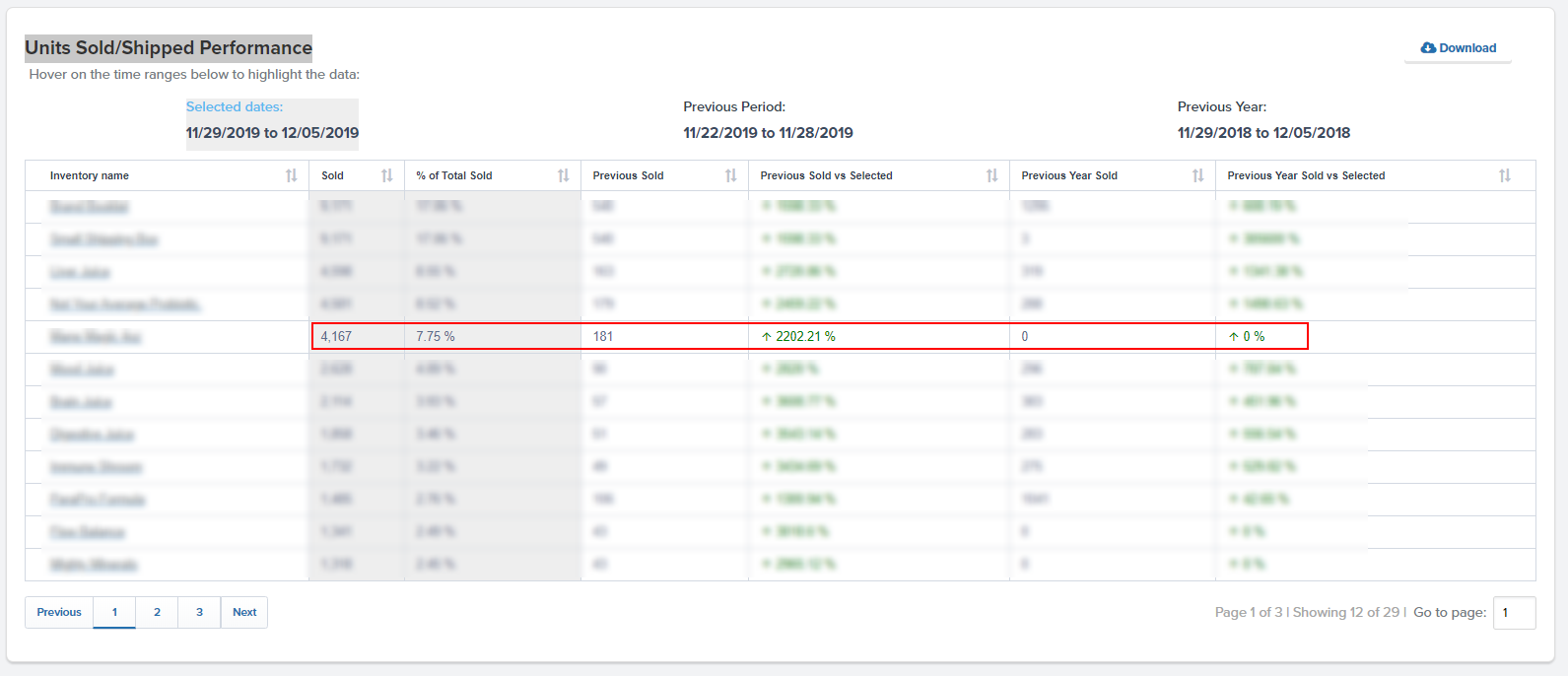

Take the most recent updated value of the firm stock and multiply it by the number of. We can calculate the stock price by simply dividing the market cap by the number of shares outstanding. As defined by trading partners the percent of retail locations stores or SKUs with a positive on-hand balance of a particular item or the percent of retail locations.

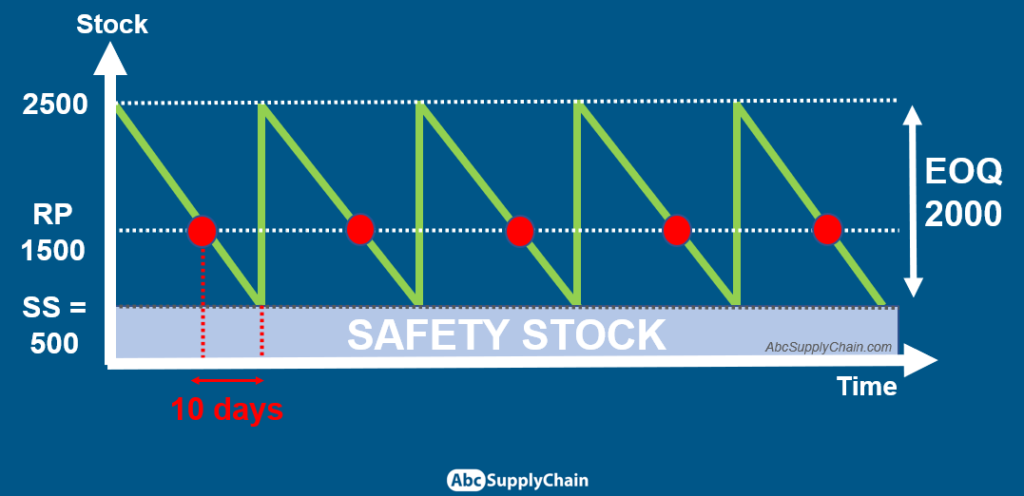

The stock turnover ratio determines how soon an enterprise sells its goods and products and replaces its. In other words we can stay that the Stock Price is calculated as. The difference is that 100 of the units on a line must be in-stock for that line to count as in-stock.

For example if there are 10000 outstanding common shares of a company. The Stock Calculator is very simple to use. Many companies will instead measure their line fill rate.

Book value per share Stockholders equity Total number of outstanding common stock. Calculate your simple return percentage. The advantages of the Upstox brokerage calculator are.

The current average interest rate on a 30-year fixed-rate jumbo mortgage is 713 030 up from last week. 2 hours agoThe measure breached 08 at the height of the early pandemic selloff and was even higher when global stock markets slumped in 2011 during the euro-zone sovereign debt crisis. A Rate of Return ROR is the gain or loss of an investment over a certain period of time.

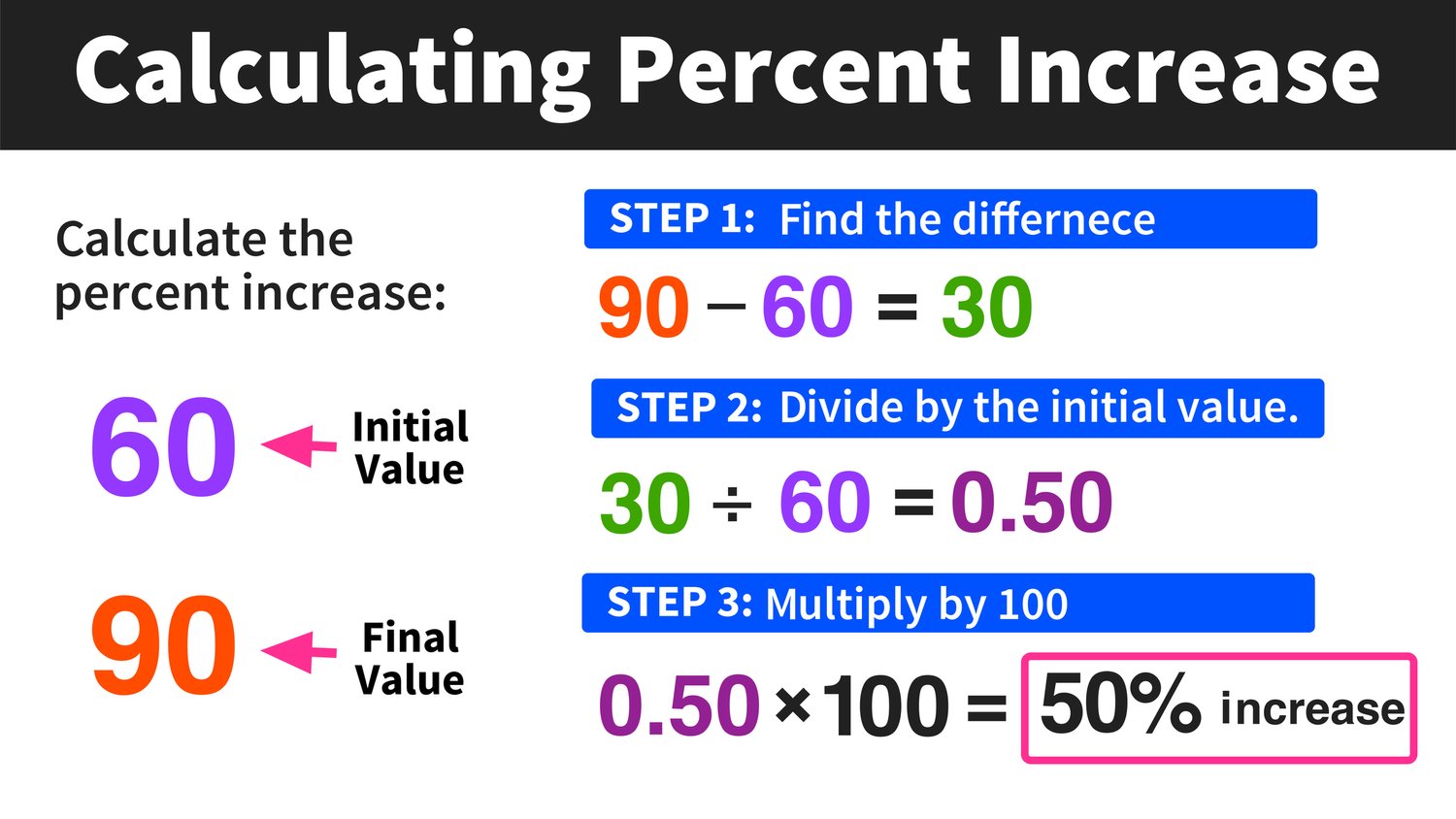

The stock turnover ratio formula is the cost of goods sold divided by average inventory. A 15-year fixed-rate mortgages monthly payment will be. The percentage change takes the result from above divides it by the original purchase price.

The 30-year jumbo mortgage rate had a. After those are filled in you divide. An implication surrounding the use of time-series data in which the final statistical conclusion can change based on to the starting or ending dates of.

Just follow the 5 easy steps below. Accurate and instant information.

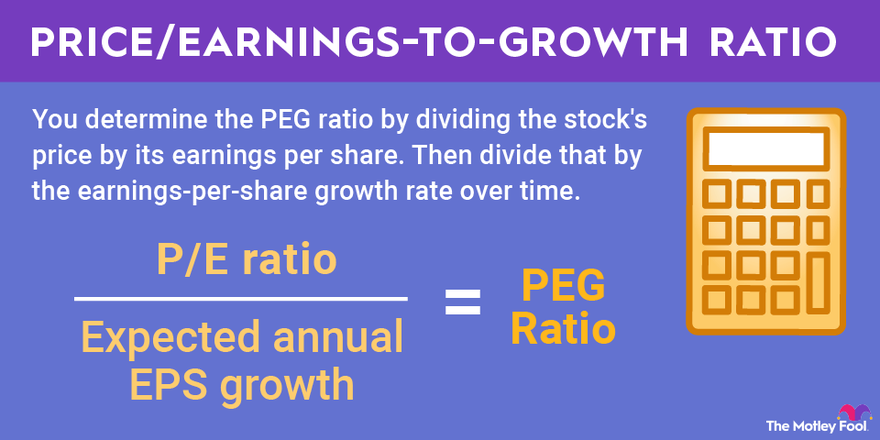

What S A Good Peg Ratio It Depends Simple Pitfalls To Avoid

What Is The Peg Ratio The Motley Fool

Optimal Inventory Levels Calculate Manage Your Stock Levels

Calculating Percent Increase In 3 Easy Steps Mashup Math

How To Calculate Weighted Average Price Per Share Fox Business

Calculating Investment Percentage Gains Or Losses

How To Calculate Stock Profit Sofi

What Is A Stock Up Price The Krazy Coupon Lady

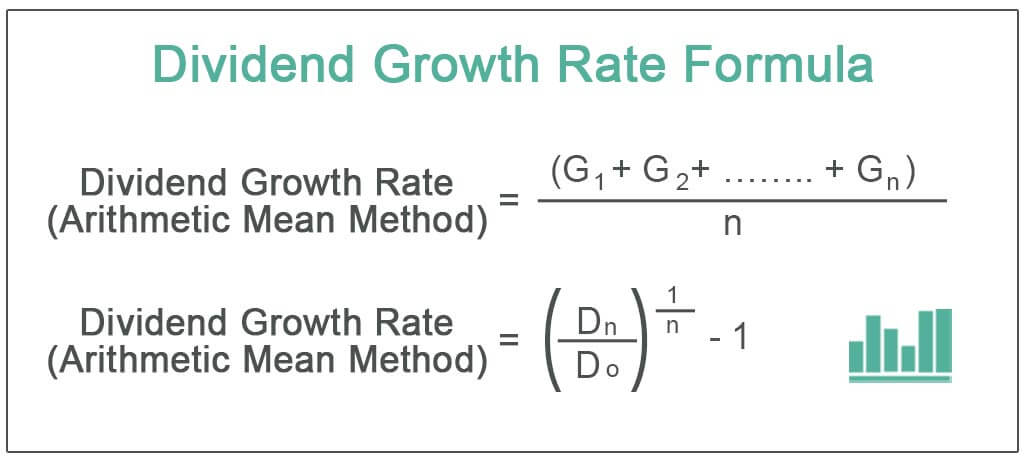

Dividend Growth Rate Meaning Formula How To Calculate

:max_bytes(150000):strip_icc()/ForcesThatMoveStockPrices2-d78bc38c16c743ffa0a8cf63184934a7.png)

Factors That Move Stock Prices Up And Down

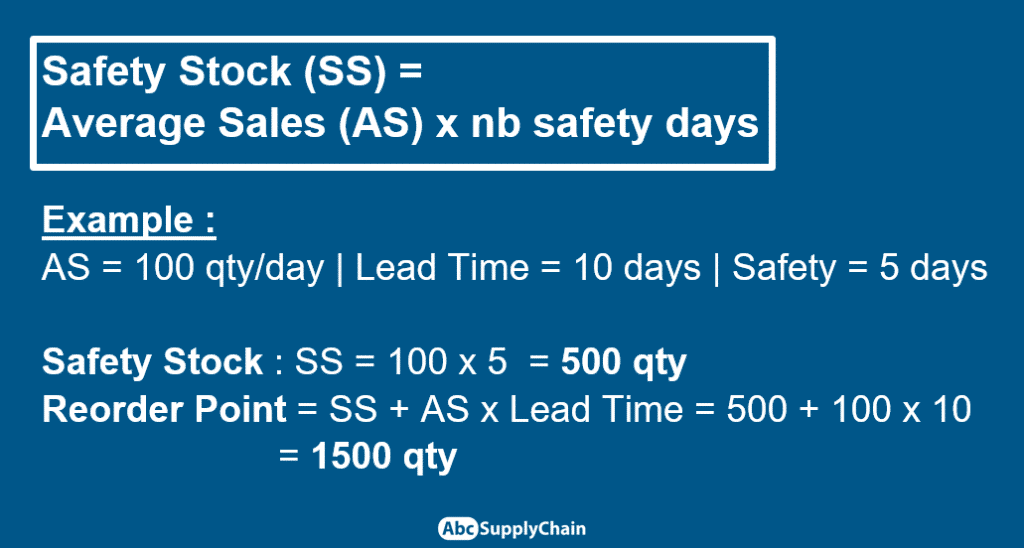

6 Best Safety Stock Formulas On Excel Abcsupplychain

How To Predict If A Stock Will Go Up Or Down Beginners Guide Getmoneyrich

How To Predict If A Stock Will Go Up Or Down Beginners Guide Getmoneyrich

Investing For Beginners How To Read A Chart Moneyunder30

A Refresher On Breakeven Quantity

How To Calculate Food Cost Percentage Using A Food Costs Formula

6 Best Safety Stock Formulas On Excel Abcsupplychain

How To Calculate The Daily Return Of A Stock Finding And Interpreting Results